Medicare Supplement Plan G (Medigap Plan G) is the most comprehensive Medicare Supplement plan available for those new to Medicare. This coverage has increased in popularity in recent years, becoming one of, if not the, most popular Medicare Supplement plan available today. Medicare Supplement Plan G fills the gap between what Original Medicare pays and the costs for which you (the beneficiary) are responsible.

Find Medicare Plans in 3 Easy Steps

Let us help you navigate your Medicare journey

Below, we review the coverage, costs, and availability of Medicare Supplement Plan G and how you can benefit from this coverage.

Like other Medicare Supplement plans, Medicare Supplement Plan G pays secondary to Original Medicare (Part A and Part B). Original Medicare does not provide full coverage for medical services. So, a Medicare Supplement plan helps cover the out-of-pocket costs for which you would otherwise be responsible.

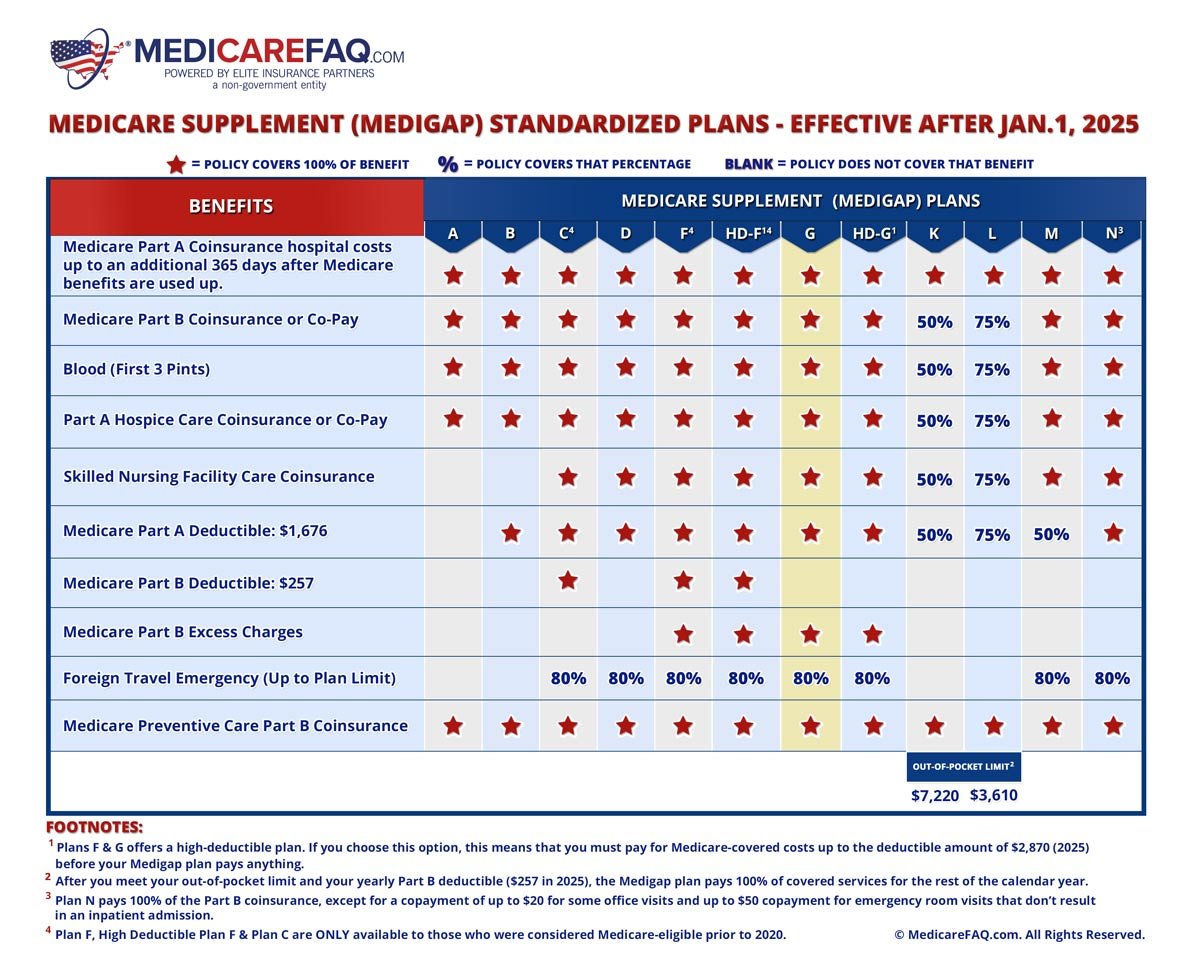

Ten standardized Medicare Supplement plans and two high deductible versions are available to those on Medicare nationwide. Each plan is identified by a letter, A through N. Each lettered Medicare Supplement plan has a different coverage level and monthly premium to meet the healthcare and budget needs of any senior on Medicare.

Medicare Supplement Plan G is one of the ten options available to seniors. Medicare Supplement Plan G is the most comprehensive plan for new Medicare beneficiaries and is a top option for all Medicare enrollees. When you sign up for Medicare Supplement Plan G, your out-of-pocket costs are a fraction of what they would be with Original Medicare. After meeting the annual deductible, additional medical costs will be covered at 100% that year.

When you enroll in a Medicare Supplement plan, you can keep all the great benefits of Original Medicare but have predictable healthcare costs. Due to plan standardization, you can receive care from any medical professional who accepts Original Medicare regardless of your Medicare Supplement carrier. A practitioner can never deny you service due to your Medicare Supplement insurance company.

Listen to this Podcast Episode Now!

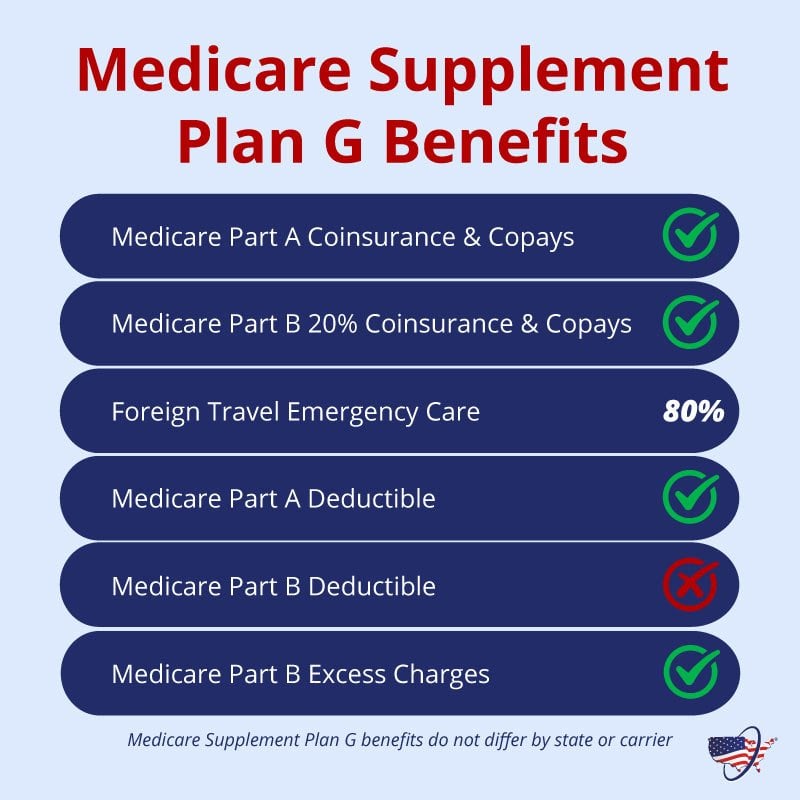

Medicare Supplement Plan G provides coverage for a wide range of services and helps cut your costs when using Original Medicare.

One of the most notable benefits of Medicare Supplement Plan G is that it covers all Medicare-related costs after you pay the Medicare Part B deductible. Other Medicare Supplement plans involve additional out-of-pocket expenses costs after you reach the Medicare Part B deductible.

Find Medicare Plans in 3 Easy Steps

Let us help you navigate your Medicare journey

Thus, the only out-of-pocket cost that a Medigap Plan G policyholder would need to cover is the Medicare Part B annual deductible. Keep in mind, this amount changes each year and your costs restart on January 1.

Additionally, your Medicare Supplement Plan G will be accepted nationwide as it would in your home state. Any doctor who accepts Original Medicare must accept your Medicare Supplement coverage as it pays secondary to the federal health plan. This is a unique benefit of Medicare Supplement plans. So, if you plan to travel in your retirement, Medicare Supplement may be right for you.

See the chart below for a complete summary of Medicare Supplement Plan G benefits.

The only cost Medicare Supplement Plan G does not cover is the annual Medicare Part B deductible.

Once you meet the Medicare Part B deductible, you will not have to worry about additional copayments or unexpected medical bills. Further, because the federal government standardizes Medicare Supplement plans, Medicare Supplement Plan G provides the same benefits regardless of the carrier. However, monthly premium rates vary by state and carrier.

Compared to other Medicare Supplement plans, Medicare Supplement Plan G is one of the most comprehensive, second only to Plan F. However, not all Medicare beneficiaries are eligible for Plan F coverage.

Find Medicare Plans in 3 Easy Steps

Let us help you navigate your Medicare journey

Due to the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), if you receive Medicare after January 1, 2020, you are no longer eligible for Medicare Supplement Plan F. Due to this change, new Medicare seniors tend to enroll in Medicare Supplement Plan G, as it is the next best option.

The only out-of-pocket cost left behind by Original Medicare not covered by Medicare Supplement Plan G is the Medicare Part B deductible. You are responsible for meeting this deductible before your Medicare Supplement benefits kick in.

Additionally, Medicare Supplement Plan G does not cover benefits for routine dental, vision, hearing, or prescription drug services.

Medicare Supplement Plan G only covers the benefits that Original Medicare will cover. Meaning that it will only pay after Original Medicare pays. So, if Original Medicare does not pay its portion, neither will your Medicare Supplement Plan G.

Suppose you are interested in these additional benefits. In that case, you will want to enroll in a separate dental, vision, and hearing plan and a Medicare Part D plan to help pay for prescription drugs.

These plans work hand-in-hand with your Original Medicare and Medicare Supplement Plan G to increase your benefits without losing health coverage.

The cost of Medicare Supplement Plan G varies depending on multiple factors, including where you live, your age, tobacco-use status, and gender. Still, Medigap Plan G’s cost ranges from around $100-$300 per month.

As a rule of thumb, monthly Medicare Supplement premiums tend to be more expensive in areas with higher costs of living.

Find Medicare Plans in 3 Easy Steps

Let us help you navigate your Medicare journey

If you find the benefits of Medicare Supplement Plan G attractive but cannot pay the monthly premium, you have another option. Medicare Supplement High Deductible Plan G offers the same benefits for a lower monthly premium. However, in exchange for the low monthly cost, you must reach a higher deductible before receiving 100% coverage.

Listen to this Podcast Episode Now!

Below we explore the costs of Medicare Supplement Plan G across three different markets. For our methodology, we’re comparing both men and women aged 65 and 75 years old. None of them use tobacco products:

| Medigap Plan G Average Monthly Cost in Las Vegas, NV (88901)* | |

| Gender: Female, Age: 65 | $280.00 |

| Gender: Male, Age: 65 | $314.00 |

| Gender: Female, Age: 75 | $298.00 |

| Gender Male, Age: 75 | $334.00 |

| *Please note: the above are sample rates. These are subject to change. Call us for your accurate, personalized quotes today. | |

| Medigap Plan G Average Monthly Cost in New York, NY (10001)* | |

| Gender: Female, Age: 65 | $494.00 |

| Gender: Male, Age: 65 | $494.00 |

| Gender: Female, Age: 75 | $494.00 |

| Gender Male, Age: 75 | $494.00 |

| *Please note: the above are sample rates. These are subject to change. Call us for your accurate, personalized quotes today. | |

| Medigap Plan G Average Monthly Cost in Chillicothe, OH (45601)* | |

| Gender: Female, Age: 65 | $238.00 |

| Gender: Male, Age: 65 | $269.00 |

| Gender: Female, Age: 75 | $250.00 |

| Gender Male, Age: 75 | $282.00 |

| *Please note: the above are sample rates. These are subject to change. Call us for your accurate, personalized quotes today. | |

| Medigap Plan G Pros | Medigap Plan G Cons |

|---|---|

| Medicare Supplement Plan G is a great alternative to Plan F | Just like Plan F, you’ll pay more per month for your benefits because you receive more options |

| Your only out-of-pocket medical expense is your Part B deductible | You may get more coverage, but you can save on premiums with other options if you don’t go to the doctor often |

| Travelers love the foreign emergency travel benefit (lifetime limit applies) | No coverage for dental and vision healthcare |

Having the help of a licensed Medicare agent can help you sift through the noise and pinpoint the right carrier for you. By comparing your coverage options, you’ll be able to pinpoint the right option for your healthcare and budget.

To enroll in Medicare Supplement Plan G, you must have Medicare Part A and Part B.

Pre-existing conditions may play a role in your Medicare Supplement Plan G enrollment, depending on when you apply for coverage and where you live. A pre-existing condition does not affect enrollment if you apply for Medicare Supplement Plan G during your Medicare Supplement Open Enrollment Period or qualify for guaranteed issue rights. During these times, a carrier may not deny you coverage for any reason.

If you enroll at any other time, you may be subject to underwriting health questions. However, specific state rules may also allow you to enroll without needing to answer these questions, so knowing what your state permits is vital.

If you live in a state that does not have exceptions and decide to apply outside of these enrollment periods, you will need to answer Medicare Supplement underwriting questions to determine your insurability. By providing answers to underwriting health questions, carriers may deny you coverage based on any findings.

Find Medicare Plans in 3 Easy Steps

Let us help you navigate your Medicare journey

Lastly, if you currently have a Medicare Advantage plan and are interested in enrolling in Medicare Supplement Plan G, you will need to switch back to Original Medicare first. You can make this change by using the Annual Enrollment Period in the fall or the Medicare Advantage Open Enrollment Period in the first quarter of each year.

Returning to Original Medicare is just the first step in making the switch from Medicare Advantage to a Medicare Supplement plan. Remember, when you enroll in a Medicare Supplement plan outside a guaranteed issue right window, you must answer underwriting health questions. This may result in the denial of your plan of choice due to pre-existing health conditions.

Unlike Medicare Supplement Plan G, a Medicare Advantage plan becomes your primary insurance once you enroll in coverage. Thus, your plan can determine a physician network, set your copayments, and restrict you from seeing specialists without a referral.

The difference between Medicare Advantage and Medicare Supplement plans is not to be taken lightly. Thus, when enrolling in either coverage, you should thoroughly understand each plan type and then decide which option works best for you.

Like the monthly premium, many factors impact your Medicare Supplement plan’s rate increases. These factors include your age at the time of enrollment and the pricing method used by your Medicare Supplement plan when you enrolled. The average Medicare Supplement Plan G rate increase is between 2% to 6% annually. Remember, this percentage can be higher or lower based on your carrier.

Understanding the rate increase history for the Medigap carrier you choose is essential. Researching carrier reviews before enrolling is key when selecting your Medicare Supplement insurance company.

There are no federal mandates requiring Medicare Supplement plans to be available to those on Medicare under 65 due to disability. Yet, some states require insurance companies offering MMedicare Supplement plans to provide at least one option to those under 65. Sometimes, these carriers allow you to enroll in Medicare Supplement Plan G.

The most common plan option available to those under 65 is Medicare Supplement Plan A. Medicare Supplement Plan A offers only the most basic benefits. However, some carriers understand the importance of widespread plan availability and will allow those on disability to enroll in Medicare Supplement Plan G.

Find Medicare Plans in 3 Easy Steps

Let us help you navigate your Medicare journey

However, when enrolling in a Medicare Supplement plan under age 65, it is important to know that your premium may be double or even triple that of someone over 65. Carriers increase the price to account for high medical costs due to your disability. However, some carriers understand the importance of widespread plan availability and will allow those on disability to enroll in Medicare Supplement Plan G.

Medicare Supplement Plan G is among the highest-rated and most popular Medicare Supplement plans. Whether you are new to Medicare or looking for a policy to fit your budget or healthcare needs better, Medicare Supplement Plan G may be the right fit.

Medicare Supplement Plan G covers 100% of your costs after the Medicare Part B deductible. So, you will see that enrolling in this plan could save thousands of dollars per year on healthcare.

Once you decide that Medicare Supplement Plan G is suitable for you, purchasing your plan through a top carrier is crucial. Working with a brokerage with access to all the top carriers in your area is the best way to ensure that you are enrolling in the right plan for you.

If you contact a carrier directly, you only receive premium rate quotes for that carrier’s Medicare Supplement Plan G option. So, by working with a broker, you will receive Medigap Plan G options from various carriers. Thus, you can decide which carrier and plan are right for you.